Running a business sounds like freedom. But it often looks like late nights copying last month’s invoice and double-checking totals while your actual to-do list grows longer. Even if your service is consistent, like a monthly retainer or a subscription, the billing part still eats up mental space you could spend on growth or rest.

That’s where recurring invoicing changes the game. With platforms like qorp.io, entrepreneurs can automate billing in a way that feels seamless — predictable for the client, invisible for you. It’s not just a technical upgrade. It’s how modern businesses reclaim time without sacrificing accuracy or control.

Why Recurring Invoices Matter for Time-Starved Entrepreneurs

Ask any founder or freelancer what they’d do with an extra three hours a week, and they’ll probably rattle off ideas that have nothing to do with spreadsheets. Yet for many, those hours are lost to routine invoicing — creating, tweaking, sending, and following up. It’s tedious, prone to error, and totally avoidable.

Recurring invoices eliminate the loop. Instead of restarting the process every month, you set it once and let it run. That’s a major shift for entrepreneurs whose time is often split between sales, delivery, support, and admin. Automation isn’t just efficient — it’s a mindset change that values your time like a real asset.

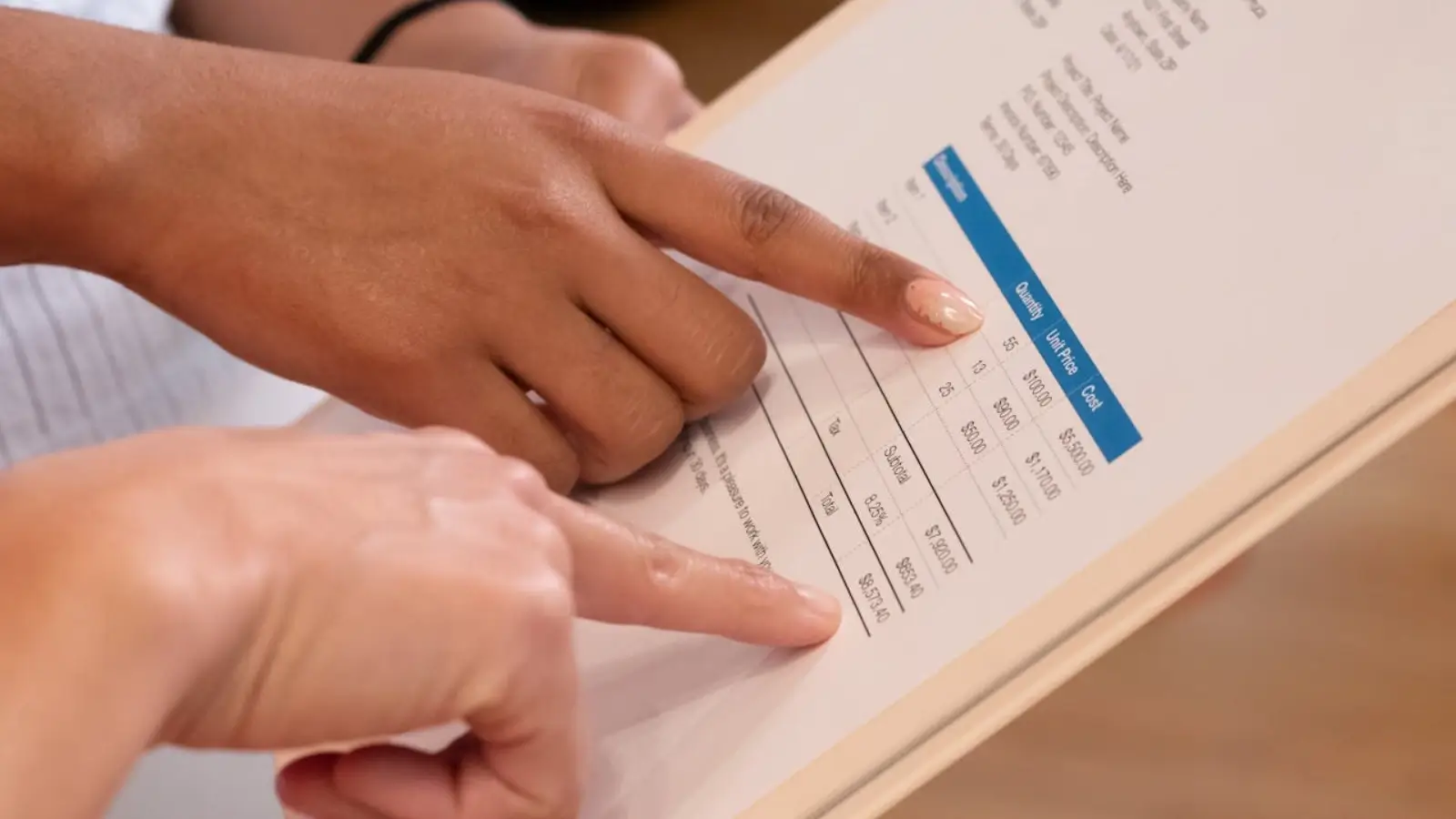

How Recurring Invoicing Works in Practice

With this system in place, you can ensure consistent, reliable billing without the constant effort of manual invoicing. It simplifies the process and keeps everything running smoothly.

Set It Once, Send It Always

Recurring invoices aren’t complicated. You pick a client, define how often they should be billed — monthly, biweekly, quarterly — and create the invoice template once. The system handles the rest: it generates and sends invoices at the exact time you choose. It can even reflect small changes, like adding hours or adjusting fees, while keeping the core structure intact.

Auto-Delivery + Smart Reminders

Instead of setting calendar alerts or chasing down clients manually, automated invoicing tools send bills out automatically. If payment doesn’t come through, smart reminders can go out based on timing or behavior — not just a generic “your invoice is due” message. That saves effort and smooths the path to faster payments.

Benefits Beyond Time-Saving

Automating recurring invoices isn’t just about having fewer tasks. It creates a ripple effect across your business by improving everything from client relationships to financial forecasting.

1. Fewer Errors, Faster Payments

Manual invoicing invites mistakes: wrong totals, duplicate entries, missed send dates. Automated systems follow logic, not memory. That keeps the process clean and consistent, and it shows clients you run a tight ship, which makes them more likely to pay on time.

2. Predictable Cash Flow

Recurring invoices contribute to steady revenue. When you know what’s coming in and when, it is easier to plan expenses, invest in tools, or hire confidently. That’s not just helpful — it’s essential for businesses transitioning from solo operations to sustainable models.

3. Mental Bandwidth Reclaimed

Even if it only takes ten minutes to create and send an invoice, the mental load adds up. Automating that task removes one more thing from your head and frees up space for deep work, new ideas, or, frankly, a break. That’s what entrepreneurs rarely admit: sometimes the biggest win is not having to think about it.

Who Needs Recurring Invoices the Most?

This system fits businesses that thrive on consistency — but that doesn’t mean they all look the same. Whether you are billing in fiat, crypto, or both, the benefits scale.

Here’s who gains the most:

- Freelancers and consultants with monthly retainers

- SaaS founders with fixed subscription tiers

- Agencies billing on a monthly scope

- Managed service providers (IT, design, content)

- Crypto-native businesses offering paid access or support

- Coaches and course creators running programs over time.

If your work happens regularly, your billing should too. Manual invoices for a monthly service aren’t just inefficient — they’re holding back your scalability.

Smart Business Starts With Automated Billing

Recurring invoices aren’t just a time-saver — they’re a signal that your business respects its own time and process. Automating billing lets you focus on what really matters: serving clients, growing smarter, and finally breathing a little easier.

With the right system in place, invoicing stops being a task. It becomes part of a rhythm — one that frees your schedule, energy, and potential. That is not just convenience. That is smart business.