Payment methods used for goods and services have changed significantly in Poland. Nowadays, Polish consumers favor digital options over cash and conventional bank transfers because they are quicker and more convenient. Instant transfers and mobile payments are now widely accepted by the nation’s businesses. This transition takes place not only in retail and online stores but also in the entertainment and gaming industries. A good example of this trend is the growing popularity of kasyno z Blikiem that allows players to make quick deposits and withdrawals using smartphones.

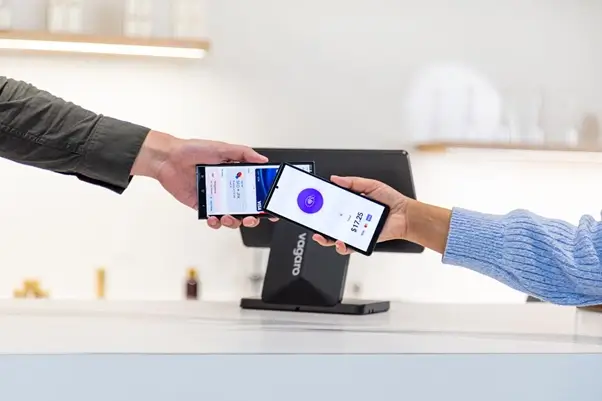

In Poland, people prefer quick, easy, and secure methods of handling their finances. Instant payments are thus growing in popularity. It only takes a few taps on your phone to make payments with services like Blik. These tools are becoming standard for many everyday tasks. Therefore, businesses are quickly changing to satisfy the demand. This includes Polish online casinos that are transforming their operations to meet users’ expectations.

Intro to Poland’s Evolving Payment Landscape

In recent years, Poland’s payment environment has undergone significant change. Customers are choosing quicker and more contemporary alternatives to cash and bank cards. Instant transfers, contactless payments, and mobile banking have become widespread in both urban and rural areas.

High smartphone usage, dependable internet access, and rising confidence in digital tools contribute to this change. Nowadays, Polish consumers believe in safe, easy, and speedy payment tools and processes. Therefore, many companies are modernizing their systems to accept quick and easy payment options.

The Demand for Speed and Convenience

Quick and simple payment options are becoming increasingly valued by Polish consumers. They desire seamless transactions free from complexities and delays. This desire for convenience shapes the way services are provided in various industries. Here are the key aspects:

- Busy lifestyle. People prefer to avoid lengthy or complicated payment procedures to save time.

- Smartphone usage. Many people use their phones for everyday tasks like shopping and banking.

- Convenient services. Easy-to-use platforms are more popular across all age groups.

- Trust in digital tools. Online payments are more secure thanks to platforms like Blik.

Thus, Poland is rapidly adopting mobile-first and instant payments as the norm.

Blik as the Polish Top Payment System

Blik has emerged as Poland’s leading payment system, widely used for online shopping, mobile banking, and ATM withdrawals. It allows users to pay by entering a short code.

Now, Blik is integrated with most major banks in Poland, allowing it to reach a large audience. Its emphasis on security and simplicity has earned the trust of millions, and Blik now plays an important role in how Poles manage their daily payments.

Casinos with Blik for Better Security and Speed

Due to the speed and security of transactions, many Polish players now favor online casinos that support Blik. This payment solution lowers the risk of fraud by allowing users to deposit money instantly without using their card information. Author and gambling expert, Kuba Nowakowski, asserts that those who desire a safe and seamless gaming experience should pay particular attention to Blik online casinos.

Every kasyno polskie na pieniadze that provides Blik attracts more customers who appreciate quick payments and mobile access. As confidence in Blik increases, more casinos implement this technique to meet players’ needs.

From Bank Transfers to Instant Payments

Slow bank transfers have given way to quick and easy instant payment methods at Polish online casinos. Better player satisfaction and faster access to funds are the driving forces behind this change.

The KasynaOnlinePolskie team created a convenient comparison table:

|

Feature |

Bank transfers |

Instant payments like Blik |

|

Speed |

1–3 business days |

Instant |

|

Ease of use |

Require account details |

A simple code or app |

|

Availability |

Limited hours |

24/7 |

|

Security |

Moderate |

High |

Instant payments now offer clear advantages for both players and casino operators.

The Growth of Mobile-Friendly Transactions

The number of mobile-friendly transactions has been rapidly increasing, since smartphones and mobile apps are widely used in Poland. Nowadays, more people use mobile gadgets to handle banking, payments, and even gaming.

With services like Blik, you can pay with a few taps instead of using cash or credit cards. Due to their convenience, users of all ages now favor mobile transactions. As a result, businesses are concentrating more on mobile solutions to meet growing customer expectations.

Role of Trust in Instant Payments

In Poland, the increasing use of instant payments largely depends on trust. When people believe their money and data are stored safely, they are more likely to use this payment tool.

Here are some vital points about Blik:

- Strong security systems. The modern payment app provides multi-factor authentication and encryption.

- Reliable banking partners. Major Polish banks support Blik.

- Positive user experience. Simple and error-free payments foster confidence.

- Clear transaction records. Users can monitor each stage of the payment process.

Instant payments are becoming a part of daily life, fostering users’ trust.

Younger Generations as a Leading Power

Younger generations in Poland, particularly Millennials and Generation Z, are driving the growth of instant payment solutions. They prefer mobile transactions that are quick, easy, and available at any time. This demographic is more willing to use apps like Blik for daily purchases, including online entertainment. Their habits are influencing the future of payment preferences throughout the country.

Potential Challenges of Blik Adoption

While Blik is rapidly expanding in Poland, some issues may prevent its widespread adoption. Not all users or businesses are prepared for this transition. Here are some key reasons:

- Limited awareness. Some people still don’t know how Blik works.

- Technical barriers. Older phones or outdated apps can cause problems.

- Merchant availability. Not all online stores or casinos accept Blik.

- User habits. Some people prefer traditional methods like cards or cash.

Overcoming these obstacles is key to wider Blik adoption.

Final Thoughts: What’s Next for Polish Payments

Poland’s payment landscape is likely to evolve further, with instant and mobile transactions becoming increasingly dominant. As more consumers realize the value of quick, secure, and simple payments, the demand for modern tools like Blik will only grow. Younger generations will continue to be the primary drivers of this trend, influencing how businesses and services respond to new payment expectations.

We can also expect more widespread use of mobile wallets, biometric verification, and deeper integration of services like Blik into numerous platforms. KasynaOnlinePolskie.com experts think that the growth of the online entertainment sector, including casinos, will cause wider acceptance of Blik. More Polish online casinos will prioritize user experience and immediate access to funds.

Despite some challenges, the future of Polish payments appears promising. Poland has the potential to become a European leader in instant digital payments for both retail and online entertainment. However, the right balance of innovation, trust, and accessibility is required.