In today’s competitive landscape, businesses are constantly seeking ways to maximize their returns on investment. As organizations strive to enhance efficiency and profitability, the right tools can make all the difference. ROI calculators have emerged as essential resources, helping companies evaluate potential gains and make informed decisions.

Homebase has long been a trusted name in this space, but emerging homebase competitors are shaking things up. Some of these alternatives are reportedly delivering returns that are 200% better than Homebase. This article explores these innovative rivals, shedding light on how they’re redefining ROI calculations and offering businesses the insights they need to thrive.

Overview of ROI Calculators

ROI calculators play a crucial role in helping businesses evaluate their investments and forecast future financial performance. These tools enable companies to identify the effectiveness of various projects and allocate resources efficiently.

Importance of ROI in Business

Understanding return on investment remains vital for businesses looking to maximize profitability. Calculating ROI allows organizations to assess the potential value of investments relative to their costs. Accurate calculations support informed decision-making, ensuring that resources focus on the most lucrative opportunities. Companies that prioritize this metric can enhance their competitive edge, optimize operations, and improve overall financial health. Incorporating consistent ROI analysis fosters a culture of accountability, guiding teams toward initiatives that drive greater financial returns.

Key Features of an Effective ROI Calculator

Effective ROI calculators offer several essential features that streamline investment analysis. User-friendly interfaces simplify data entry, while customizable templates allow for tailored assessments based on specific business needs. Real-time data integration enhances accuracy, ensuring calculations reflect current market conditions. Advanced reporting features provide visual representations, making insights easily digestible for stakeholders. Furthermore, compatibility with other financial tools ensures seamless integration into existing workflows, maximizing efficiency. These attributes work together to offer businesses a reliable framework for evaluating potential investments and understanding their financial implications.

Homebase and Its Competitors

Homebase stands out in the ROI calculator market, recognized for its user-friendly design and comprehensive features. This platform enables businesses to calculate expected returns on investments efficiently, empowering companies to make informed decisions. The calculator integrates real-time data and generates reports that help teams understand financial implications quickly. Its customizable templates allow users to tailor estimates according to specific project needs, enhancing accuracy in evaluation.

Numerous emerging alternatives, as documented by Business Outstanders, show promise, attracting attention for their innovative approaches. These competitors leverage advanced technologies to deliver higher returns, with reports indicating up to 200% improved outcomes over traditional tools. Some alternatives focus on industry-specific functionalities, accommodating unique needs for diverse sectors. Others emphasize data analytics, providing deeper insights that foster proactive decision-making. The competition fosters growth and innovation, compelling all players to enhance service quality continually while delivering substantial value to businesses.

Comparison of Homebase Competitors

Emerging competitors offer features that drive significant returns, significantly outperforming established options in the market. These alternatives provide innovative solutions tailored to specific industries, enhancing user experience and operational efficiency.

Company A: Features and Benefits

Company A presents a robust ROI calculator equipped with a customizable dashboard that allows users to visualize data in real time. The platform integrates seamlessly with existing financial tools, optimizing workflow and reducing manual entry errors. Users benefit from industry-specific templates and advanced analytics that detect trends and offer actionable insights, enabling quick, informed decision-making. Additionally, thorough reporting capabilities assist in tracking performance over time, ensuring businesses can adapt quickly to market changes.

Company B: Features and Benefits

Company B stands out with its intuitive interface, designed for ease of use even for non-financial professionals. The calculator focuses on automation, offering predictive analytics to forecast potential returns based on historical data. Users can leverage its comprehensive support resources, including tutorials and expert guidance, which enhance the learning experience. Furthermore, the platform emphasizes collaboration, allowing teams to share calculations and results easily, fostering a culture of transparency and shared responsibility.

Company C: Features and Benefits

Company C distinguishes itself through its emphasis on data security and compliance. The ROI calculator adheres to industry regulations, ensuring user data remains protected. Customizable features enable users to modify calculations according to changing business needs or specific investment criteria. The platform also employs machine learning algorithms to continuously refine its prediction accuracy. Users gain access to a community forum for sharing best practices and troubleshooting, enriching the overall user experience and enhancing collective knowledge across industries.

Analyzing 200% Better Returns

Competitors in the ROI calculation space are achieving remarkable returns on investment, outperforming traditional providers by up to 200%. This new wave of tools focuses on integrating specific metrics that enhance clarity and effectiveness in financial decision-making.

Metrics Used for Evaluation

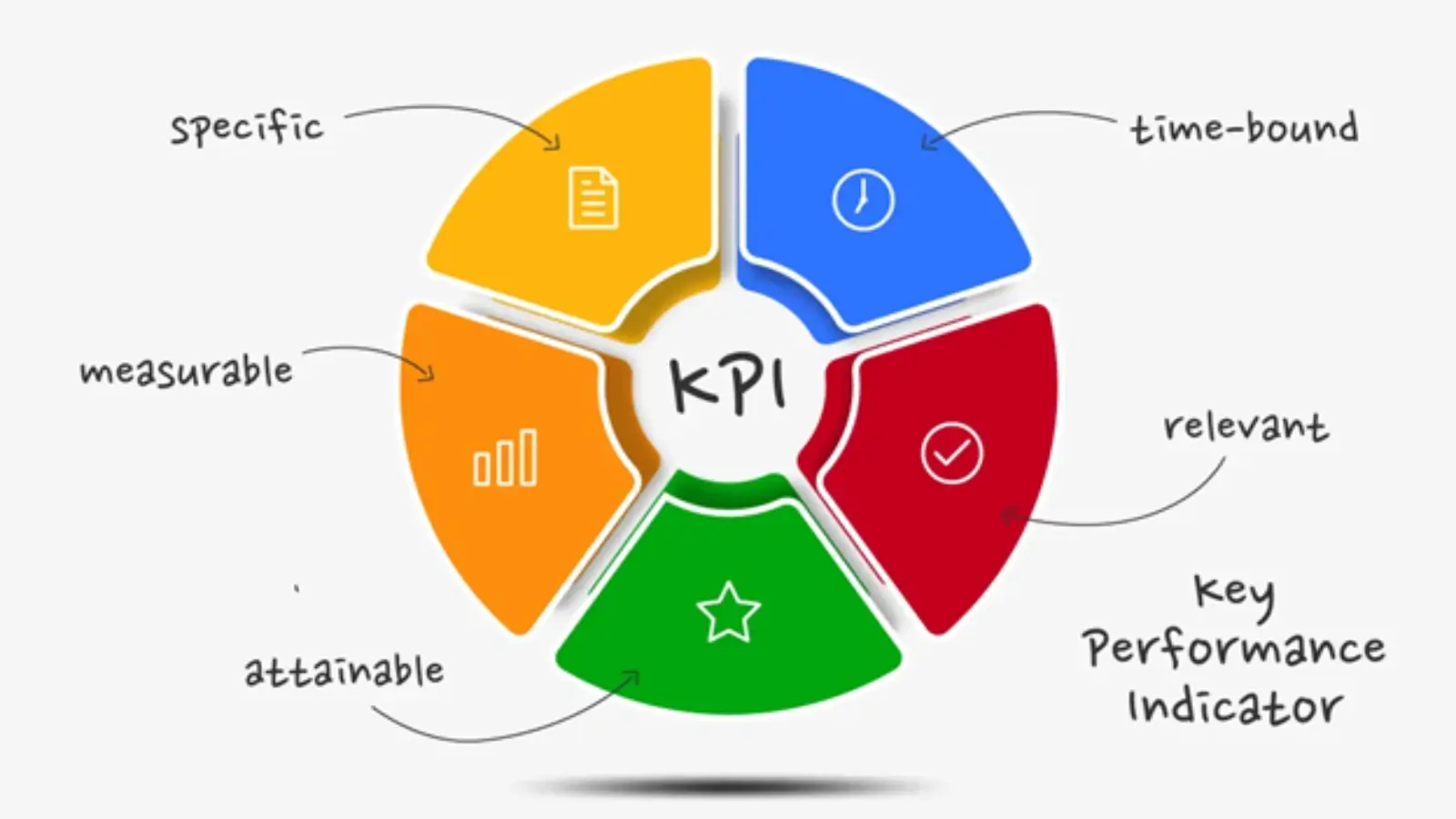

Key metrics play a crucial role in evaluating investment performance. Some of the most impactful include internal rate of return (IRR), net present value (NPV), and payback period. IRR assesses the potential profitability of an investment, offering insights into overall growth prospects. NPV calculates the value of future cash flows relative to initial costs, aiding in long-term planning. The payback period measures how quickly an investment can recover its initial costs, providing immediate context for decision-makers. This structured evaluation process equips businesses with actionable data to drive informed choices.

Case Studies and Success Stories

Numerous companies have successfully transformed their financial strategies through advanced ROI tools. Company X, by implementing a tailored calculator, increased investment returns by 150% within the first year. The tool's user-centric design allowed for easy customization and integration of real-time data. Similarly, Company Y utilized an innovative platform that streamlined project evaluations, resulting in a 200% boost in ROI over two years. These success stories underscore the effectiveness of modern approaches in generating superior financial outcomes, demonstrating the potential for significant enhancements in investment strategies.

Conclusion

The landscape of ROI calculators is rapidly evolving with new competitors stepping up to deliver exceptional returns. By harnessing advanced technologies and focusing on specific industry needs these alternatives are reshaping how businesses evaluate investments. The ability to achieve returns that surpass traditional providers by 200% highlights the significance of selecting the right tools for financial forecasting.

As organizations strive for enhanced profitability and efficiency understanding ROI becomes essential. Leveraging the insights provided by these innovative calculators empowers businesses to make informed decisions that drive growth. Embracing these advancements not only fosters a competitive edge but also cultivates a culture of accountability and strategic resource allocation. In this dynamic environment staying ahead means exploring these options and adapting to the best solutions available.