When it comes to taking care of their finances, many struggle because they don’t know how to go about it. One common aspect that many find challenging, regardless of how they earn, is budgeting. While there are many reasons why a budget may not work, a common one is that it’s too rigid, or too unrealistic, or doesn’t accommodate some expenses. That's where the 50/30/20 rule comes into play, a simple but effective budgeting strategy that you can try.

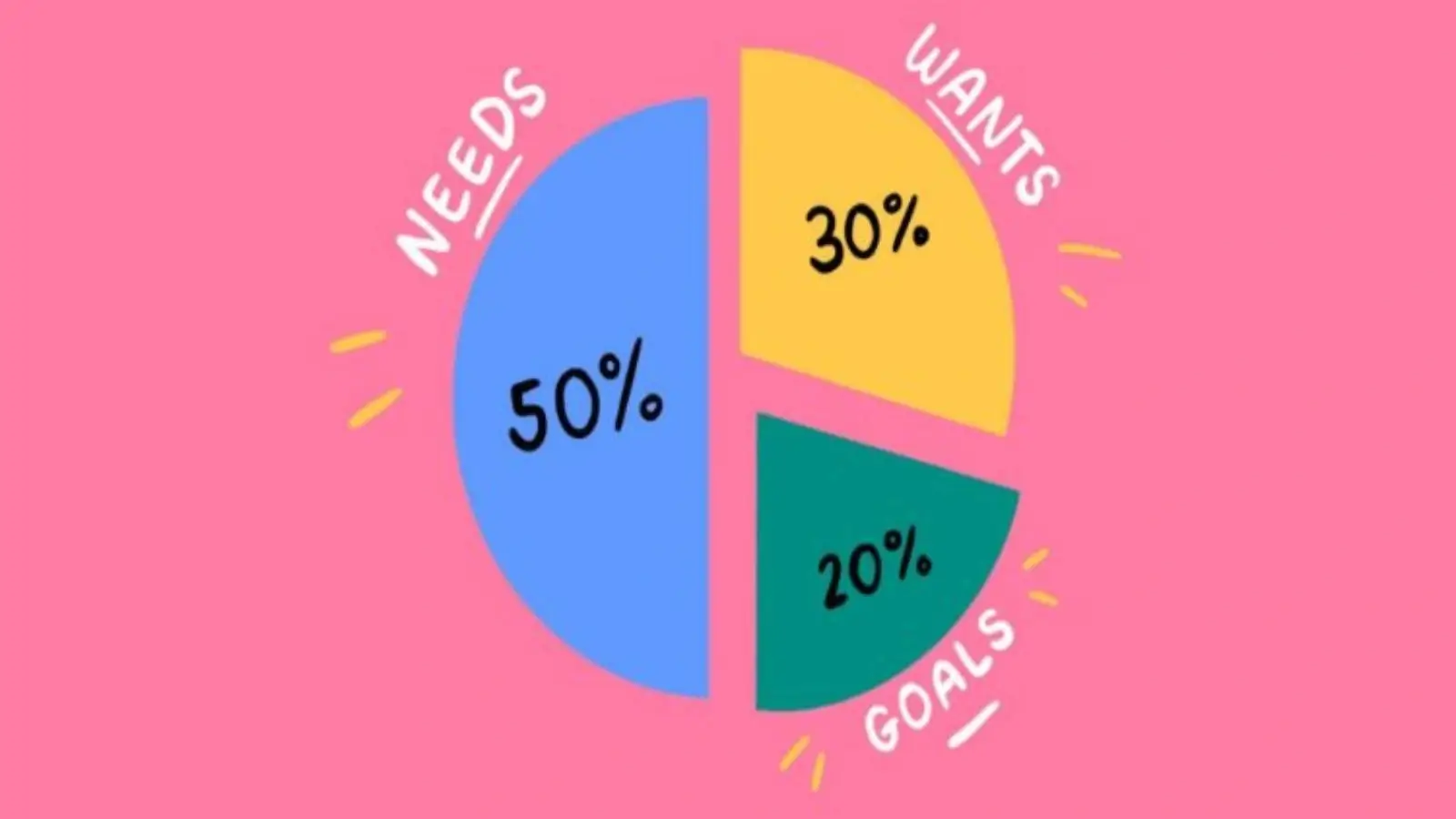

This budgeting strategy helps break down your after-tax income into 3 categories:

Many other budgeting rules are rigid, making it difficult to stick to them. But this rule is based on the understanding that some of your income should go towards you having fun and enjoying life instead of just cutting down on costs entirely. So, it helps create a balance between discipline and flexibility. It ensures that you first spend on your essentials, and then you can spend on your wants. Knowing you can use 30% of your income on your wants can keep you motivated to continue categorising your finances according to this rule. The best part about this rule is that you can utilize it at any stage of your life, whether you’ve just graduated or are a seasoned veteran.

Budgeting apps and finance calculators have made it easy to start planning out a budget, helping make the whole process less overwhelming. By connecting your accounts and categorizing your expenses, these tools help you get a real-time understanding of your spending habits. A 50/30/20 calculator can be very helpful as you get to create a functional budget without all the guesswork. It also helps you set realistic allocations instantly. Platforms like SoFi provide calculators like this that help eliminate all the manual work and make the process a lot more convenient and easier.

At the end of the day, the best budget is one you can stick to. The 50/30/20 rule not only works because it's so thorough, but because it sets realistic standards that you can keep up with. By balancing needs, wants and savings, you can achieve financial stability in no time. If you want to start managing your money smartly, then the best way to start is to try the 50/30/20 calculator to see how it fits in with your goals.