Netflix Nears Deal to Acquire Warner Bros. Discovery, Potentially Reshaping Hollywood

— The industry is watching closely, any final agreement could shape entertainment for years to come.

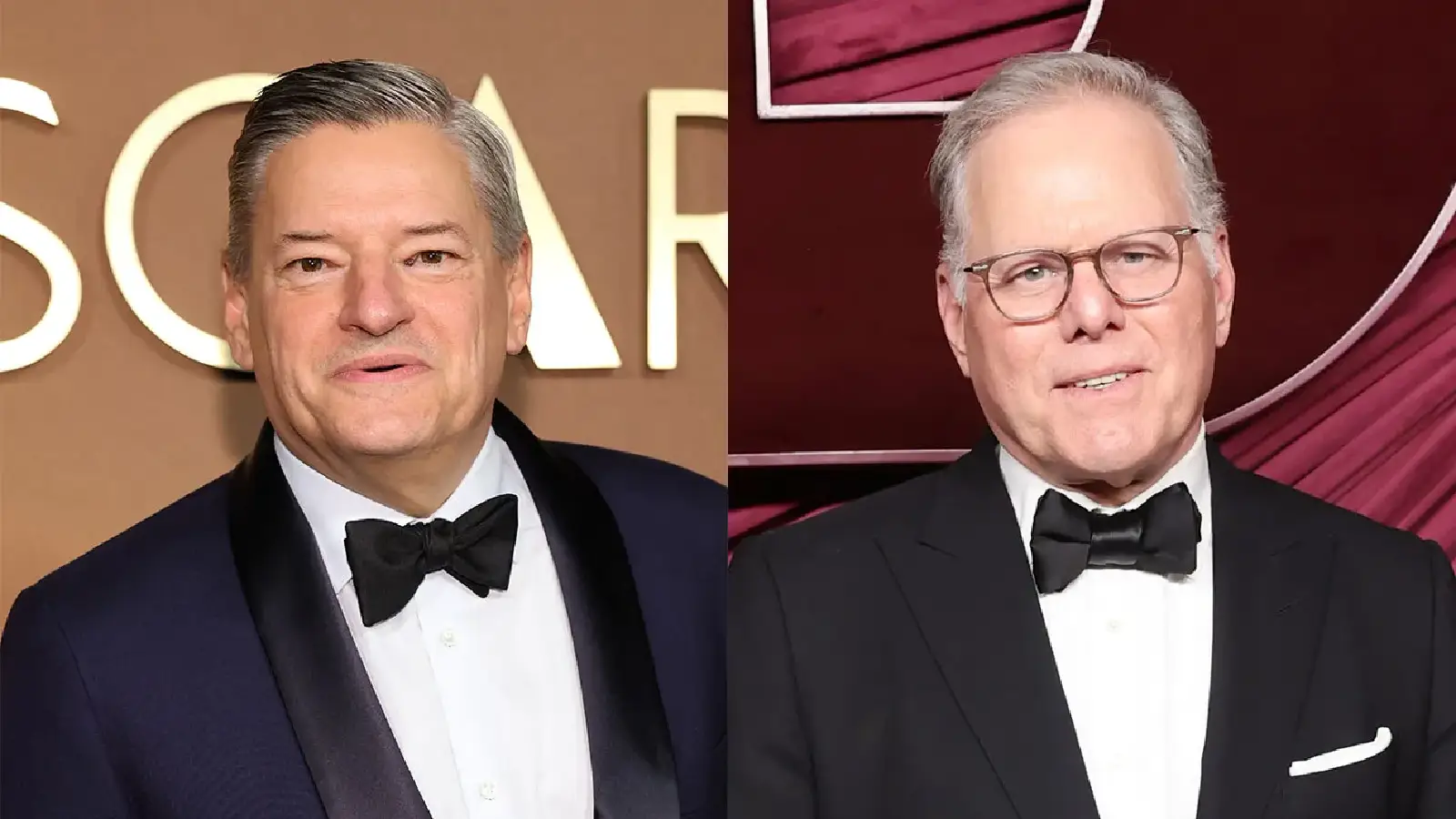

Netflix, under Ted Sarandos and Greg Peters it is in exclusive talks to buy Warner Bros. in a potentially paradigm-shifting deal that would change the entertainment landscape. Discovery’s studios and streaming platform HBO Max. That the deal has eclipsed competitive offers from Paramount and Comcast is a sign of how power dynamics in the business are changing.

Netflix is said to have offered about $28 a share, besting Paramount’s $27 bid with a monster break-up fee of an1 additional $5 billion on top of that for regulatory obstacles. The deal is not yet sealed, subject to potential examination by American and European regulators who are likely to take a dim view of Amazon expanding its power in the crowded streaming marketplace, which will make it difficult for Amazon to gain approval.

If the deal comes through, Netflix will reign over Warner Bros’. storied film and TV studios, affecting theatrical releases, studio operations and the fate of HBO Max. The move has worried some of Hollywood’s conventional executives who fear it may stunt the future of theatrical exhibition and change the industry’s ways for how movies will reach audiences.

The deal also points to the future of premium television and Warner Bros.’ linear TV assets that are expected to keep operating as stand-alone units if the merger goes through. As those negotiations unfold, the industry is watching closely, any final agreement could shape entertainment for years to come.